Brussels Reacts to Trump’s Greenland Pressure: Emergency EU Summit and Trade Countermove Options

The European Union is moving to contain a fast-rising political and trade dispute after U.S. President Donald Trump linked the Greenland question to the threat of new tariffs against several European countries. EU leaders are now preparing an extraordinary summit in Brussels to coordinate a unified response, as the confrontation begins to blur the line between geopolitics and market pressure. With NATO drawn into consultations and European officials openly weighing countermeasures, the next steps will hinge on whether the standoff shifts toward negotiation—or hardens into tit-for-tat escalation.

Brussels calls an extraordinary summit as Greenland dispute intensifies

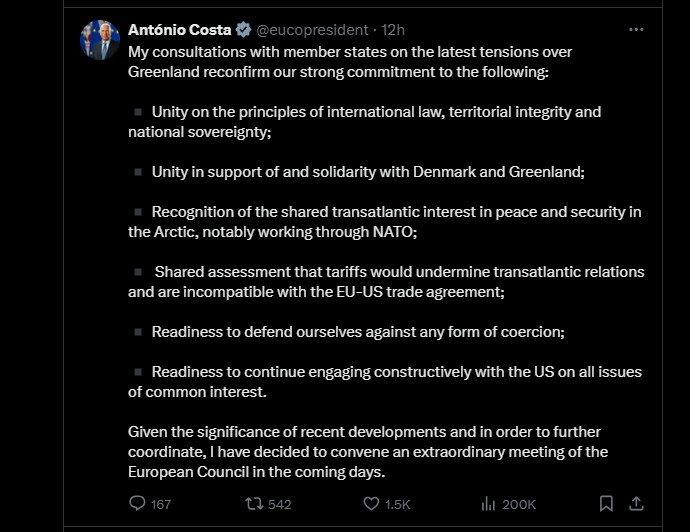

EU leaders are preparing to meet on short notice in an effort to present a coherent line, particularly given Denmark’s central role in the dispute. Greenland is an autonomous territory within the Kingdom of Denmark, making the issue unusually sensitive for the bloc: it touches both on a member state’s position and on broader principles the EU routinely defends, including territorial integrity and political self-determination.

European Council President Antonio Costa has said the leaders’ meeting will take place “in the coming days” in Brussels. Parallel consultations among member-state representatives have already begun, focused on aligning diplomatic messaging and mapping the range of potential responses—before national interests and economic exposure start pulling the EU in different directions.

The Arctic context adds another layer. Greenland’s strategic importance has grown alongside shifting global attention toward the region’s security dynamics, infrastructure, and resources, raising the stakes of any dispute that appears to question existing sovereignty arrangements.

Trump’s tariff leverage and the “sale of Greenland” demand

The immediate trigger is Trump’s pressure tactic: tying the prospect of an agreement on Greenland to escalating trade penalties. The demand referenced in public reporting centers on an arrangement described as a “full and complete sale of Greenland,” coupled with the threat of tariffs if the White House does not see movement.

According to accounts cited in international coverage, the tariff schedule under discussion would start at 10% from 1 February, with the possibility of rising to 25% from 1 June if no deal is reached. The list of potential targets extends beyond Denmark to several allied European countries, including Germany, France, the United Kingdom, the Netherlands, Norway, Finland, and Sweden—suggesting a strategy designed to widen the economic impact and increase political pressure across multiple capitals at once.

Greenland has repeatedly rejected the idea of becoming part of the United States. That stance matters because it places local self-determination at the center of a dispute otherwise dominated by strategic arguments. With a small population and strong sensitivity to external decision-making, Greenland’s position raises the political cost of any outcome perceived as transactional or imposed.

EU countermeasures under discussion: tariffs or single-market restrictions

Inside the EU, the early debate has followed a deterrence logic: if pressure arrives via trade tools, Europe can respond with trade tools. Two broad options have emerged in consultations. One would impose tariffs on U.S. imports, with figures circulating around an estimated €93 billion package. The other, considered more severe, would involve limiting U.S. companies’ access to parts of the EU single market—an escalation that goes beyond customs duties and into the rules governing who can operate, compete, and sell services in one of the world’s largest economic zones.

The first route would primarily affect conventional flows—goods and supply chains where U.S. companies are deeply embedded in European demand. The second would be structurally more confrontational, potentially affecting regulated sectors and the operating conditions of American firms, with consequences that could outlast any single tariff cycle.

The EU’s Anti-Coercion Instrument also sits in the background as a legal framework designed for moments when a third country attempts to force political decisions through economic pressure. In practice, it offers a pathway toward targeted countermeasures after assessment and attempts at de-escalation—signaling that Brussels has been building institutional tools precisely for scenarios of trade-linked coercion.

For businesses, the message is straightforward: uncertainty is no longer theoretical. A tariff clash or market-access restrictions can reshape costs, disrupt planning, and amplify supply-chain volatility. For consumers, the risk is that economic retaliation feeds into higher prices and additional pressure in a still-fragile inflation environment.

NATO consultations add a security dimension to an economic dispute

While the EU focuses on political unity and economic options, NATO has been pulled into the crisis through the security framing surrounding Greenland and the Arctic. NATO Secretary General Mark Rutte is expected to hold talks in Brussels with representatives from Denmark and Greenland amid the escalation.

Reports indicate that Greenland’s foreign minister Vivian Motzfeldt and Denmark’s defense minister Troels Lund Poulsen are due at NATO headquarters, without a press conference announced in advance. The meeting is widely read as an effort to prevent the dispute from opening a deeper rift among allies—particularly at a time when alliance cohesion is seen as central to European security.

European messaging has emphasized that Arctic security can be strengthened through allied cooperation within existing arrangements, rather than through sovereignty changes. Put simply, Brussels is aiming to neutralize the “strategic necessity” argument by insisting that the same objectives can be met through NATO coordination and established commitments.

What happens next: Davos diplomacy, de-escalation paths, and escalation risks

The coming days bring two parallel tracks. The extraordinary EU summit is meant to lock in a common position quickly, reducing the chance that the crisis fractures into competing national responses. At the same time, international gatherings such as the World Economic Forum in Davos offer informal space for back-channel contact—an arena where leaders can test concessions, adjust timelines, and soften rhetoric without triggering immediate policy moves.

A controlled de-escalation scenario would likely involve separating the Greenland dispute from trade measures, dialing down public threats, and leaning into negotiation. An escalation scenario would see tariffs implemented, followed by European countermeasures and possibly wider restrictions—moving the conflict from political theater into economic reality, where compromise is harder and the knock-on effects spread faster.

The EU also faces a longer-term credibility question. If a territory linked to a member state can be treated as a bargaining chip in trade talks, the bloc risks weakening its own claims about rules-based order, sovereignty, and the limits of coercion.

Longer-term stakes: a sharper Arctic contest and a tougher EU–U.S. baseline

Even if the immediate clash cools, the episode highlights a structural shift: the Arctic is becoming a more explicit arena of strategic competition, and economic tools are increasingly used to pursue geopolitical aims. Greenland sits at the intersection of these trends—symbolically as a sovereignty test, and practically as a location with rising security relevance.

For the EU, the crisis could accelerate debates on strategic autonomy and on the ability to respond in a unified manner when economic pressure is used as political leverage. For NATO, it raises an institutional challenge: managing serious disagreements among allies without creating fractures that competitors can exploit.

Ultimately, the dispute puts a direct question to European decision-makers: where do the boundaries lie when economic power is used to influence sovereign outcomes? The extraordinary summit in Brussels is designed to produce an answer—not only for this crisis, but for the playbook Europe may need in future confrontations where geopolitics and trade become inseparable.